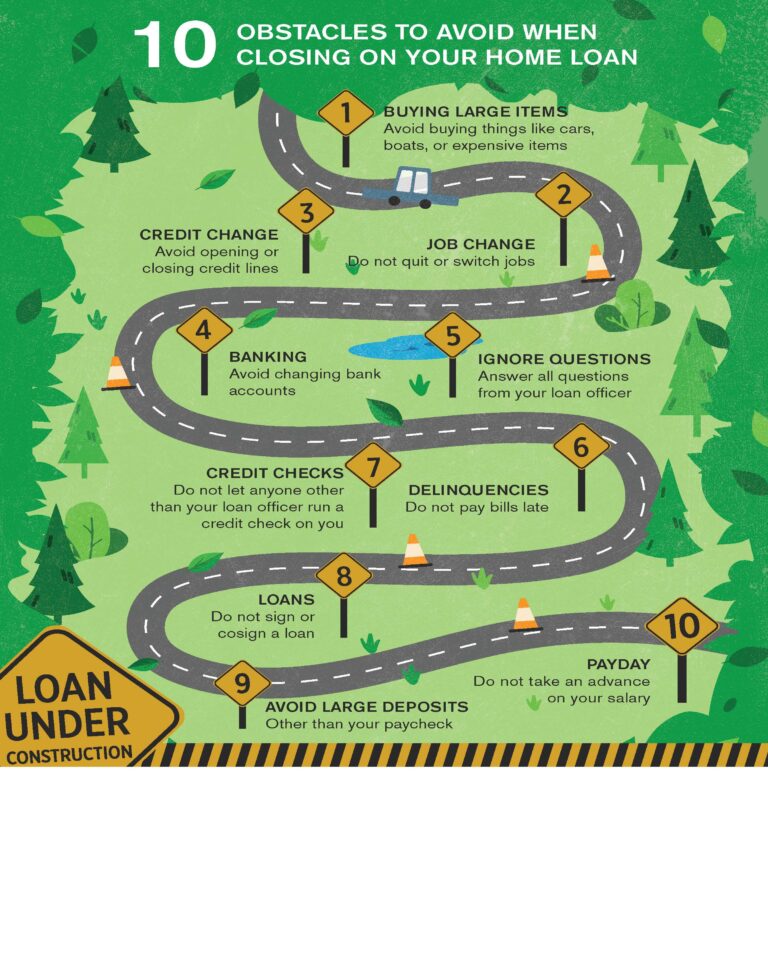

It takes some time to close even the most straightforward of home loans. These tips offer insight for avoiding pitfalls in between application and closing, so you can help make your loan process as quick and easy as possible!

1. Buying Large Items

Avoid buying things like cars, boats, or other high-end items. Purchases like these can alter your debt-to-income ratio or amount of reserves and may impede your home loan qualification or delay your loan closing. It’s best to wait, review your budget after closing, and make any large purchases you can comfortably afford at that time.

2. Job Change

Quitting your job or changing jobs can have an impact on your home loan qualification. If you plan to make a move to a new position or company, try and hold off until after closing if possible. Most employers will be understanding your need to wait.

3. Credit Change

Avoid opening or closing credit lines. Opening new cards create hard inquiries on your credit report, and closing credit lines may increase your credit utilization. Either one of these could lower your credit score and potentially change your interest rate or home loan qualification.

4. Banking

Avoid changing bank accounts. Underwriters often need bank statements and records in order to approve your loan. Changing banks can mean needing to provide all new statements, and can delay closing.

5. Ignore Questions

Answer all questions from your loan officer. Your loan officer is gathering information and documentation from you that is vital to your home loan closing. Ignoring requests from your loan officer or loan processor could cause closing delays.

6. Delinquencies

Do not pay bills late. Even one late payment can have a major impact on your credit score, and even after the payment has been made it still takes time for your score to rebound. This change in your credit score could have a negative impact on your rates or home loan approval, so it’s very important to be extra vigilant and avoid any late payments prior to closing.

7. Credit Checks

Do not let anyone other than your loan officer run a credit check on you. Many credit checks create hard inquiries on your credit report, which can lower your overall credit score. This can alter your rates and home loan qualification, so it is best to avoid any credit checks until after your home loan has closed.

8. Loans

Do not sign or cosign a loan. Obligating yourself to a different loan prior to closing affects your debt to income ratio. Even cosigning for someone else means you are still liable for the payments on this other loan. The best-case scenario is that your loan officer will need additional documentation for you regarding this new loan, which could delay closing. The worst case is that this new loan would negatively impact your debt to income ratio to the point where you no longer qualify for your home loan!

9. Avoid Large Deposits (Other than your paycheck)

Mortgage Companies are required by federal law to look into large deposits, so any unusual large bank deposits often need a written explanation and this could delay your home loan closing.

10. Payday

Do not take an advance on your salary. This can alter your payment schedule which might hinder your home loan approval.

From application to closing, our entire team at First Home Mortgage will be working our hardest to ensure the best customer service and smoothest process for each and every one of our clients! If you or someone you know is looking to purchase or refinance a home, contact one of our experienced loan officers today!